Pvm Accounting for Dummies

Table of ContentsSome Known Factual Statements About Pvm Accounting Facts About Pvm Accounting UncoveredSome Known Incorrect Statements About Pvm Accounting Our Pvm Accounting StatementsThe 10-Minute Rule for Pvm AccountingA Biased View of Pvm Accounting

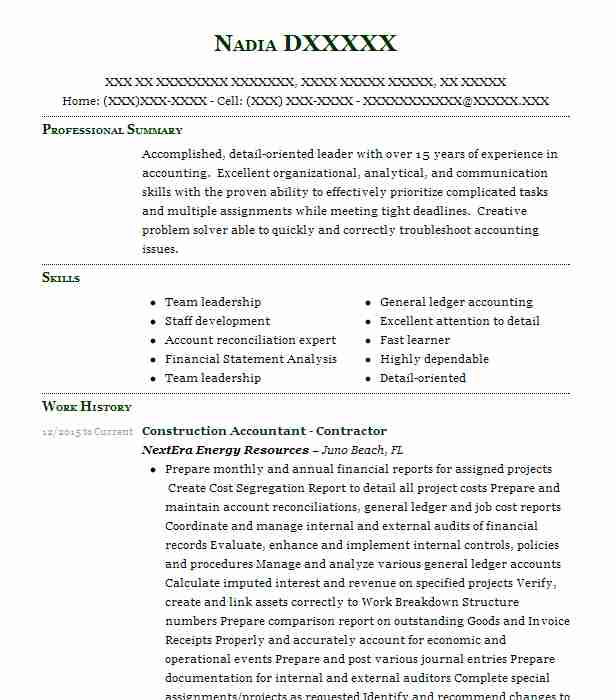

Look after and take care of the production and authorization of all project-related invoicings to consumers to promote excellent communication and stay clear of problems. Clean-up bookkeeping. Guarantee that proper records and documents are submitted to and are upgraded with the internal revenue service. Guarantee that the audit process conforms with the law. Apply called for building audit standards and procedures to the recording and coverage of building and construction activity.Communicate with various funding companies (i.e. Title Business, Escrow Business) regarding the pay application procedure and needs needed for payment. Assist with executing and preserving inner economic controls and procedures.

The above statements are meant to describe the general nature and degree of job being done by individuals assigned to this classification. They are not to be interpreted as an exhaustive list of responsibilities, responsibilities, and abilities called for. Employees might be called for to do duties outside of their typical obligations once in a while, as required.

The Best Guide To Pvm Accounting

Accel is looking for a Construction Accounting professional for the Chicago Workplace. The Building Accountant carries out a selection of bookkeeping, insurance policy conformity, and job administration.

Principal obligations include, yet are not limited to, managing all accounting features of the company in a prompt and accurate way and supplying records and schedules to the business's certified public accountant Firm in the preparation of all monetary declarations. Makes sure that all accounting procedures and functions are handled precisely. In charge of all monetary records, pay-roll, banking and everyday procedure of the audit function.

Functions with Task Supervisors to prepare and publish all regular monthly invoices. Generates monthly Job Price to Date records and working with PMs to reconcile with Task Supervisors' budget plans for each project.

Pvm Accounting for Dummies

Proficiency in Sage 300 Building And Construction and Genuine Estate (formerly Sage Timberline Office) and Procore building and construction monitoring software application an and also. https://yoomark.com/content/pvm-accounting-full-service-construction-accounting-firm-if-you-spend-too-much-time. Need to likewise excel in various other computer software program systems for the preparation of records, spread sheets and other accountancy analysis that may be needed by management. Clean-up bookkeeping. Should have solid business skills and capacity to prioritize

They are the economic custodians that guarantee that building and construction projects stay on spending plan, adhere to tax obligation guidelines, and keep financial openness. Building and construction accountants are not simply number crunchers; they are tactical partners in the building and construction procedure. Their main duty is to manage the monetary elements of building projects, making sure that sources are allocated efficiently and monetary risks are minimized.

The Buzz on Pvm Accounting

They work carefully with job managers to produce and check budgets, track expenses, and projection economic demands. By keeping a limited grasp on task financial resources, accountants help avoid overspending and financial problems. Budgeting is a cornerstone of effective building projects, and construction accountants are instrumental in this regard. They develop in-depth budget plans that include all project expenditures, from products and labor to permits and insurance coverage.

Building accounting professionals are well-versed in these laws and guarantee that the task complies with all tax needs. To excel in the duty of a construction accountant, people require a strong academic structure in bookkeeping and financing.

In addition, certifications such as Licensed Public Accounting Professional (CPA) or Licensed Construction Market Financial Specialist (CCIFP) are highly related to in the sector. Functioning as an accountant in the building sector features an unique set of challenges. Building tasks frequently include limited due dates, transforming regulations, and unforeseen costs. Accountants should adapt rapidly to these obstacles to maintain the job's monetary health and wellness undamaged.

Unknown Facts About Pvm Accounting

Ans: hop over to these guys Building and construction accountants create and check spending plans, identifying cost-saving chances and ensuring that the project stays within budget plan. Ans: Yes, building and construction accounting professionals handle tax obligation conformity for construction projects.

Intro to Building And Construction Audit By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Building and construction companies need to make challenging choices amongst numerous economic options, like bidding on one job over another, selecting funding for products or tools, or establishing a project's revenue margin. Construction is a notoriously unpredictable industry with a high failure price, sluggish time to settlement, and inconsistent money circulation.

Manufacturing involves repeated procedures with quickly recognizable expenses. Manufacturing needs various processes, products, and equipment with differing costs. Each task takes place in a brand-new location with varying website conditions and one-of-a-kind difficulties.

Some Ideas on Pvm Accounting You Should Know

Long-lasting connections with suppliers ease settlements and enhance effectiveness. Irregular. Constant use different specialty service providers and providers influences performance and capital. No retainage. Repayment shows up completely or with regular repayments for the complete agreement quantity. Retainage. Some section of settlement may be kept up until task conclusion also when the service provider's job is finished.

While typical makers have the advantage of regulated environments and maximized production procedures, building companies have to constantly adjust to each new task. Even rather repeatable tasks call for adjustments due to website conditions and other variables.

Comments on “The Ultimate Guide To Pvm Accounting”